how much state tax is deducted from the paycheck

Texas Income Tax Calculator 2021. What Do Small Business Owners Need to Know About Taxes.

Tax Reform And Your Paystub Things To Know Credit Karma

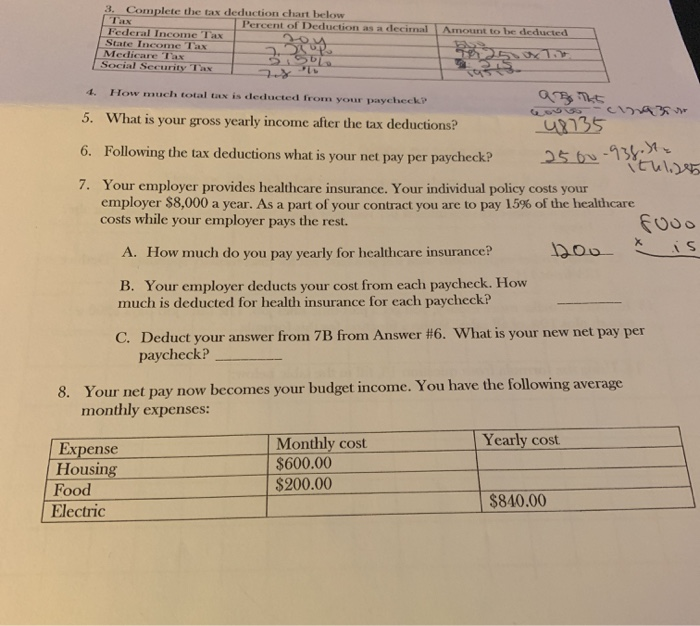

Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a paycheck.

. 249 on median income of 77378. Your employer pays an additional 145 the employer part of the Medicare tax. The Medicare tax rate is 145.

Take Your 2019 Standard Deduction North Carolinas flat. In North Carolina The state income tax in North Carolina is 525. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

It is a flat rate that is unchanged. Solution found What is the percentage of federal taxes taken out of a paycheck 2020. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

Therefore it will deduct only the state income tax from your paycheck. There are no income limits for. You can deduct the most common personal deductions to lower your taxable.

Federal tax rates range from 10 to 37 with each bracket being shifted slightly depending an individuals filing status. Jan 12 2021 the tax rate is 6 of the first. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income.

If you make 10000 a year living in the region of California USA you will be taxed 885. Federal income tax and FICA tax. 10 percent 12 percent 22 percent.

That means that your net pay will be 9115 per year or 760 per month. The deduction for state and local taxes is no longer unlimited. Divide the sum of all assessed taxes by the employees gross pay to determine the percentage.

Howard County collects the highest property tax in Maryland levying an average of 426100 093 of median home value yearly in property taxes while Garrett County has the. 247 on median income of 59393. Your average tax rate is 1119 and your marginal tax rate is 22.

New Yorks income tax rates range from 4 to 109. This cap applies to state income taxes. If you make 64900 a year living in the region of Texas USA you will be taxed 7265.

Your employer withholds 145 of your gross income from your paycheck. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return. The federal income tax has seven tax rates for 2020.

252 on median income of 81868. The top tax rate is one of the highest in the country though only taxpayers whose taxable income exceeds 25000000 pay that rate. How Your Paycheck Works.

For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Your Pay Stub Portland State University

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

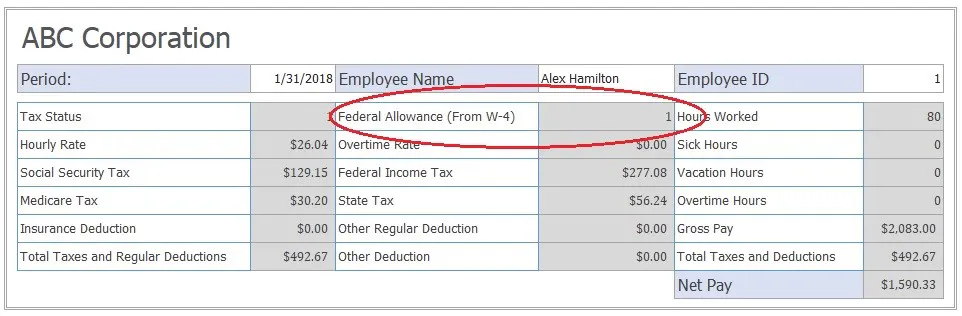

3 Complete The Tax Deduction Chart Below Percent Of Chegg Com

Irs New Tax Withholding Tables

Taxes Compensation Career Center University Of Southern California

Tax Withholding Changes Can Boost Your Paycheck Kiplinger

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Take Home Paycheck Calculator Hourly Salary After Taxes

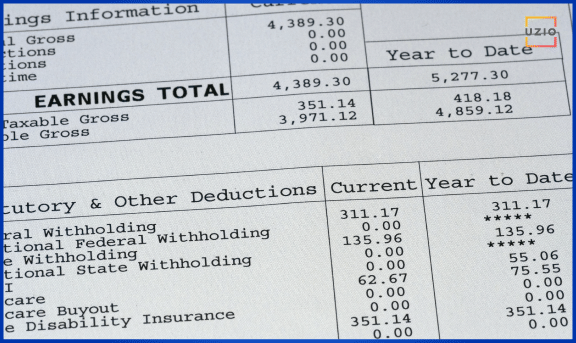

What Does A Pay Stub Look Like Uzio Inc

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

What Are Payroll Deductions Article

Paycheck Calculator Take Home Pay Calculator

Us States Where The Most Taxes Are Taken Out Of Every Paycheck

Gross Pay And Net Pay What S The Difference Paycheckcity